#7 - Investing in Wine

Once the domain of the rich and famous, tech is now democratizing wine.

|

Welcome to issue #7 of Alternative Assets by Stefan von Imhof. Each week I explore unique investment ideas, with a focus on digital assets.

I hope you enjoyed last week’s issue on fractional website ownership. I got quite a big bump in subscribers after that issue, so yeah. Thank you for all your shares!

This week I’m stepping away from digital assets to explore a topic that many of us know and love — wine. 🍷 And in typical fashion, while writing this I’ll be drinking a GSM from the Barossa Valley, so please excuse any sloppy typos. Let’s dive in!

Photo by Yoko Correia Nishimiya on Unsplash

The history of investing in wine

Wine is one of the world’s top 10 most popular alternative investments. For over 300 years, fine wines have been traded amongst wealthy collectors. But a mass market for buying and reselling wines for profit only really got going in the late 1970s. Like so much else, it kicked into high gear during the 80s, and has been a mainstay alternative asset class ever since.

Somewhat surprisingly, regulation was far less stringent in Europe than in the United states. Illinois was the first state to allow selling wine without a retail license. And even today, most US states only allow private wine sales through official auctions, where the auction houses take a ridiculously fat cut of each sale (15% - 25%).

Interest continued to boom throughout the 90s, unquestionably fueled by demand from the hundreds of millions of new Chinese middle-class citizen. During the late ‘90s and early 2000s, the world saw a huge rise in wine quality, availability and prices.

The period between 2004 and 2007 was considered the high-water mark for fine wine investing, giving the industry its first tannin-laden taste of a bubble. But with the onset of the global financial crisis, along with a few very high-profile cases of fraud, the bubble began to pop in 2008. By 2011 the market had stabilized, and has been on the rebound ever since.

Who’s investing in wine?

Up until recently, the answer to this question was, “If you have to ask, you aren’t one of them.” 😃

Traditionally, wine investors are exactly who you’d expect them to be: ultra-high net worth individuals with more money than they know what to do with; equally interested in diversifying their portfolio and looking for ways to appear interesting at parties.

Financials and posturing aside, serious wine investors also admire the flavor, subtlety, and history of each bottle. One of the most famous wine investors is Bill Koch (yes, he’s related to the Koch brothers, but he’s one of the good ones). His famous wine cellar, which includes bottles from the 1700s that were once owned by Thomas Jefferson himself, recently sold a whopping $22m worth of wine at auction.

The most expensive bottle ever sold was a 73-year-old bottle of French Burgundy, sold in 2018 for $558,000 — about $116,000 per glass, or over $20,000 per sip. 😲

Why invest in wine?

There’s a few things that make wine an interesting investment option.

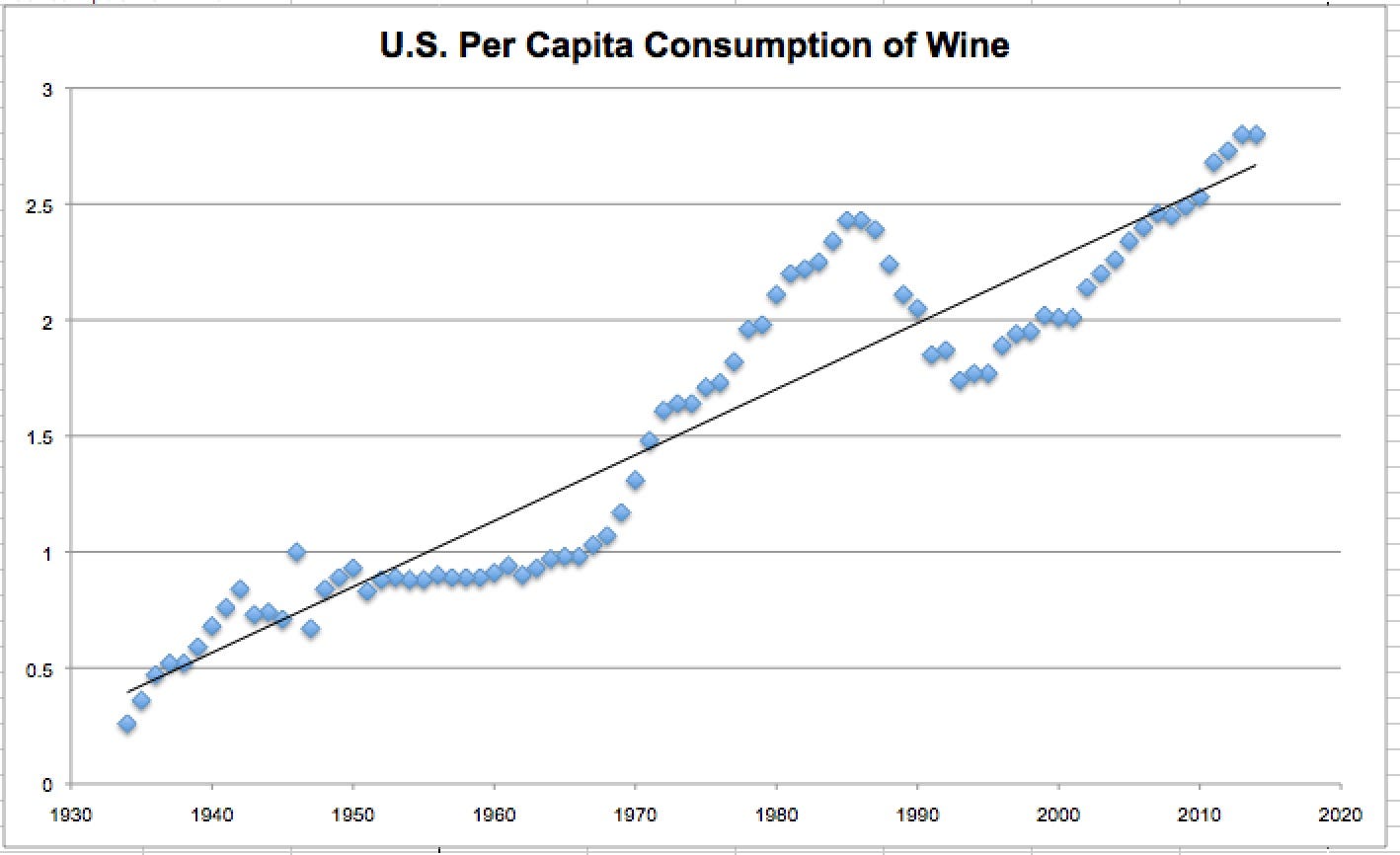

First, supply of fine wine is naturally limited by geography, arable land, and historical production capacity. Not only are there a finite number of bottles that can be produced each year, but wine continues to get consumed in greater numbers each year. Compound that with the fact that nearly all investment-grade wine comes from France — specifically the Bordeaux region — and you have a recipe for a highly supply-constrained market.

In a nutshell, demand is high, supply is somewhat limited, and it continues to get drunk every day. Sure, this trend could certainly stall out or even reverse, but in the long run this works as sort of a natural price appreciation mechanism.

Source: fermentationwineblog.com

Second, the actual quality and scarcity of fine wine appreciates over time. You don’t need to be a wine drinker to understand the term, “aged like a fine wine.” All else being equal, a 2015 bottle from a specific vineyard will taste just a bit better, and thus be just a bit more valuable, than its exact 2020 counterpart.

In many respects, wine can actually be considered a veblen good; that is, as the price of wine rises, demand actually increases instead of decreases.

Historical returns

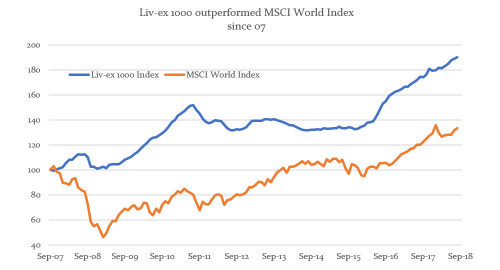

Wine investments have outperformed other investment options — and the class has been remarkably stable over the past 35 years. It has delivered an average annualized return of 13.6% per year over the past 15 years. The asset class has been surprisingly immune to the Great Recession, stock market volatility, and interest rate changes.

The fine wine market has outperformed most global equities and ETFs, and is less volatile than real estate or gold. More importantly, it seems to have a rather low correlation with sluggish stock markets.

Source: Liv-Ex.com, the de facto gauge of global fine wine prices.

Wine fraud risk

As with so many other investments, wine has attracted its fair share of scam artists, and the risk of fraud is real.

The most infamous wine investment scam was run by Rudy Kurniawan, who singlehandedly re-labeled up to 10,000 bottles and passed them off as older vintages to dozens of unsuspecting high-profile buyers.

In the early 2000s, Rudy inserted himself into the scene of Hollywood’s wine hobnobbers, forging connections with movie producers and wine aficionados. He began spending up to $1 million per month at wine auctions — essentially cornering the market — and was a big reason for the wine price inflation of the mid 2000s.

In 2012 he was arrested and sentenced to 10 years imprisonment. He is currently serving time at a federal prison in Texas, and is scheduled to be released in a few months. To this day, there are thousands of counterfeit wine bottles floating around wine cellars across the globe. Nobody knows exactly how many, and frankly, nobody wants to find out.

There’s an interesting documentary on Netflix right now about this crazy story called Sour Grapes. It’s definitely worth a watch!

A scene from Sideways, another great movie about wine. As a former Santa Barbara resident I may be biased, but it’s probably the greatest movie about wine ever made.

SPONSORED LINK

ActionBuddy

Are you a procrastinator? Of course, we all are. Say goodbye to procrastination with ActionBuddy and their unique accountability program.

Each week, ActionBuddy matches you up with someone who holds you accountable for your most important tasks. If you don't get all of your essential actions done, you give money to something or someone you don’t like. I’ve personally tried this, and found the psychology behind it super interesting. Check it out.

🍷 How to invest in wine

Surprisingly, there are no ETFs that give direct exposure specifically to wine. If you’re looking to invest, there are a few ways to go about it.

Buy bottles yourself

If you want to buy and resell bottles yourself, the primary way to obtain them is through wine auctions, wine brokers, and wine stock exchanges. If you go this route, you’ll also need to transport, store, and insure your bottles.

Wine auctions

In most US states, you can attend a wine auction without a license. But laws vary quite a bit, so you’ll definitely need to check first. Again, the United States is oddly backwards when it comes to all things alcohol, so it’s generally easier to attend & bid on wine in international markets.

A good rule of thumb is that you need a minimum of USD $10,000 - $20,00 to build up your collection, and start investing in bottles that will produce a decent return. Just like with other investment classes, it makes sense to invest in a diverse portfolio from different wine regions and vintages to spread your risk. And you’re going to want to do a ton more research before you get involved (far more research than I can provide here, sorry.)

Wine brokers

A wine broker is an independent agent who buys and sells wine for or on behalf of investors for a set commission. Similar to buying businesses and digital assets, brokers provide a world of knowledge and expertise. Oh, and they’ll also have an importing license, which is pretty important if you want to get the good stuff from France.

Beverage Trade Network has a database directory of wine and whisky brokers. You can post your buying mandate and connect with suppliers.

Wine stock exchanges

There are a number of wine stock exchanges; marketplaces where professional buyers and sellers meet. While new ones pop up every few years, the most trusted & well-established exchange is liv-ex.com.

Transportation, storage, and insurance

What, you mean don’t have access to a massive wine cellar? Luckily, professional storage companies exist to properly house your bottles as they age. Upon purchase, these companies will insure and transport your wine to chilled warehouses, which themselves are bonded to protect your investment.

Photo by Daniel Vogel on Unsplash

Pooled wine funds

Another option is purchasing shares in a wine investment fund that pools the investors' capital.

Wineinvestmentfund.com is a UK-based group that works with institutions, financial intermediaries and accredited investors around the globe. They acquire solely Bordeaux wines, all of which is stored in a UK government-bonded warehouse. There is no duty or VAT to pay, and there is no UK capital gains charge either.

Still, despite the tax advantages that pooled wine funds offer, remember that wine is not an income-producing asset. Stored wine produces no return for you until it is sold. And insurance and storage costs will mean the you’re losing money while waiting for the wine's value to appreciate. So your capital is essentially tied up for years, and there is very little you can do about it.

But luckily there’s an even easier way to invest…

Vinovest

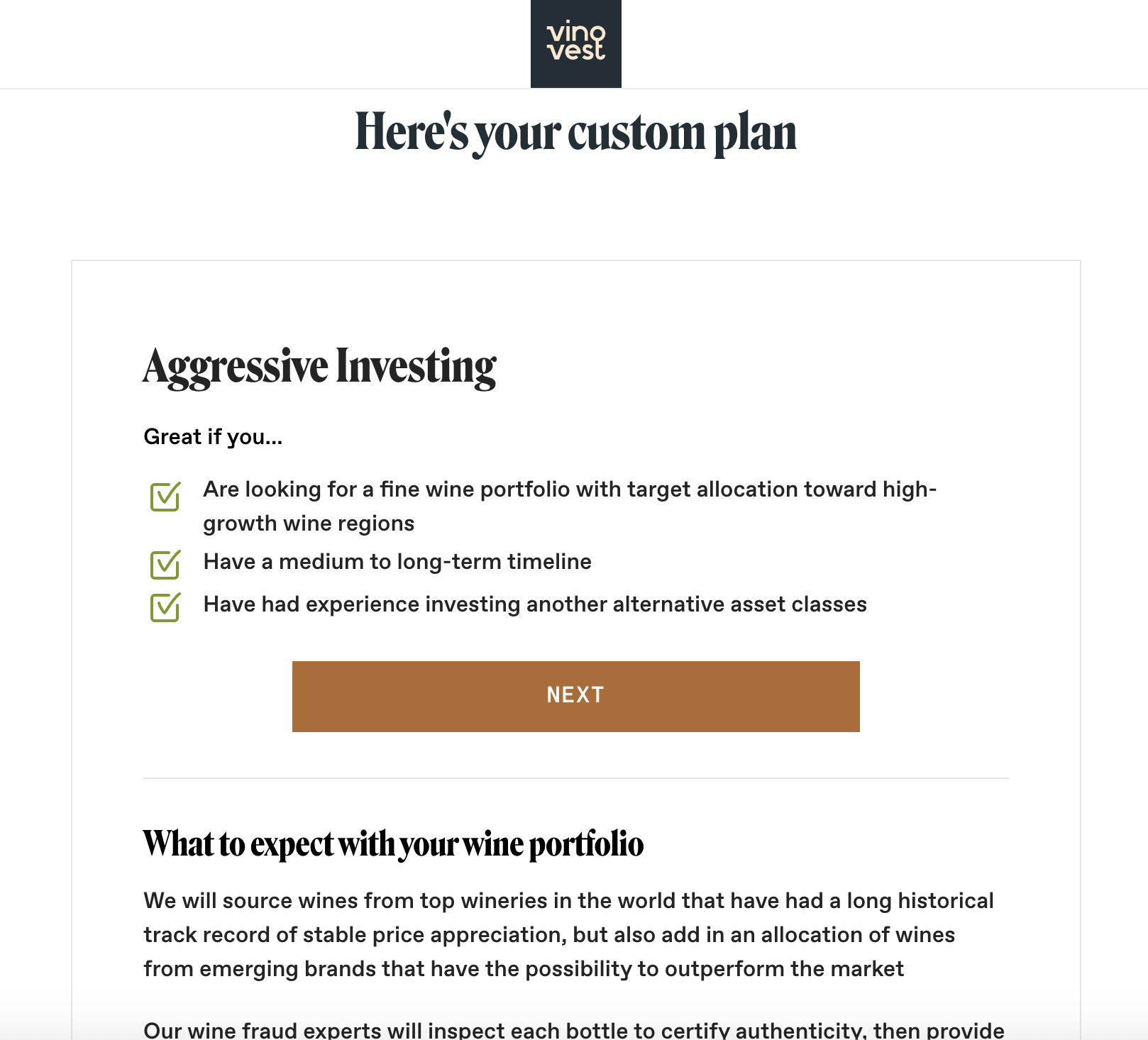

If this space interests you but you don’t have sufficient knowledge and capital to get started, or if you just want a piece of the action at a smaller entry point, check out Vinovest.

Vinovest lets you invest into a diverse portfolio of fine wines, with a minimum investment of just USD $1,000. They have the institutional knowledge and access to vineyards, suppliers, and buyers that most investors lack.

After understanding your style and risk profile, they build a portfolio of authentic wines for you to invest in, then store and manage it for you in one of their insured facilities around the world.

You can watch your wine investments grow in real-time, and can choose to sell a portion or all of your portfolio at any time. They help you find a counterparty buyer and help deliver your wines to the buyer — a process which typically takes 4 to 6 weeks.

But to me, the coolest part is that if you decide you’d rather drink your investment, you actually have the opportunity to do so! The bottles you’ve invested in can be shipped right to your doorstep whenever you want.

For all of this, Vinovest charges a 2.85% annual fee (2.5% for an investment portfolio over $50,000). This fee includes handling wine buying, wine fraud detection, storage, insurance, portfolio management, and eventual selling.

Invest in winemaking operations

Another way for investing directly in the wine-making process is WineFunding, which its founders call the world’s first wine equity crowdfunding platform.

There are three options for investing here. An equity option channels investors into what is effectively a small stake in a winery. A second option is a wine bond, which like corporate debt, funds a company’s capital needs. Until the principal is returned, interest is paid in wine.

The third investment option acts like a wine future, where an investor provides money for a specific project (vineyard acquisition, winery construction, equipment purchases, etc.) Your investment is returned over several years, also in the form of wine. Currently, all of the funded projects are in France, though the platform is open to everyone.

Finding an edge

It’s absolutely possible to get an edge in this world. Taste is subjective, and tastes change over time. Some undervalued wines today may be considered luxury goods in the future. Oh, and the entire wine “value system” the world relies on is based on literally one man’s taste, as this mind-boggling Twitter thread explains.

This is the story of how one mans palette and scoring system changed the world of wine and globalized wine styles and when the herd move one way and bought everything, there are bargains to be had in the things they left behind.

Other news

Huge news this week as the SEC announced they’ll finally be making changes to accredited investor laws. Under current SEC rules, individuals who wish to invest in private markets must earn over USD $200,000 per year ($300,000 for shared income between spouses), or hold at least $1 million in assets, excluding one’s home. This means 90% of households are effectively shut out of private investment opportunities.

The new changes take knowledge, experience, and certifications into consideration, making it easier for smart, motivated individuals to invest in whatever they deem appropriate. Personally, I think the laws (which were originally enacted to protect gullible farmers during the Great Depression) should be abolished completely. But in the meantime, this is great news. And of course there are plenty of investment alternatives for those who seek them!

That’s it for this week’s issue. If you enjoy reading this newsletter, please share it with someone who’d be interested!

Thank you for your support. It means a lot to me and helps keep this party going.

See you next week!

- Stefan

Raoul Pal @RaoulGMI

Raoul Pal @RaoulGMI