Aspirational weekly musings on consumer culture. This newsletter is penned by Li Jin, an angel investor and startup advisor who most recently spent 4 years as consumer investing p...

Aspirational weekly musings on consumer culture. This newsletter is penned by Li Jin, an angel investor and startup advisor who most recently spent 4 years as consumer investing p...

| by Li Jin May 14 |

[Clayton Christensen’s writing has been hugely influential on my thinking. So when Cliff Maxwell, Christensen’s former Chief of Staff and student at HBS, reached out to discuss my work on the Passion Economy, I jumped at the chance to explore the intersection of our ideas. He has been an invaluable thought partner, collaborator, and editor. -Li]

My blog post last year “The Passion Economy and the Future of Work” defined the Passion Economy as follows:

New digital platforms enable people to earn a livelihood in a way that highlights their individuality. These platforms give providers greater ability to build customer relationships, increased support in growing their businesses, and better tools for differentiating themselves from the competition. In the process, they’re fueling a new model of internet-powered entrepreneurship.

New tools make it easier than ever for prospective workers to earn an income by tapping into one’s passions and unique skills. Examples include writers on Substack publishing their own subscription newsletters, professional video game streamers on Twitch and Caffeine, video course creators on Teachable and Podia, and online teachers on K-12 learning platforms Outschool and Juni Learning.

By developing new products and services that are cheaper, simpler, and more convenient, workers in the Passion Economy can tap into large segments of consumers who previously could not access or afford, or were over-served, by traditional offerings. In this way, Passion Economy businesses have the potential to disrupt incumbent companies.

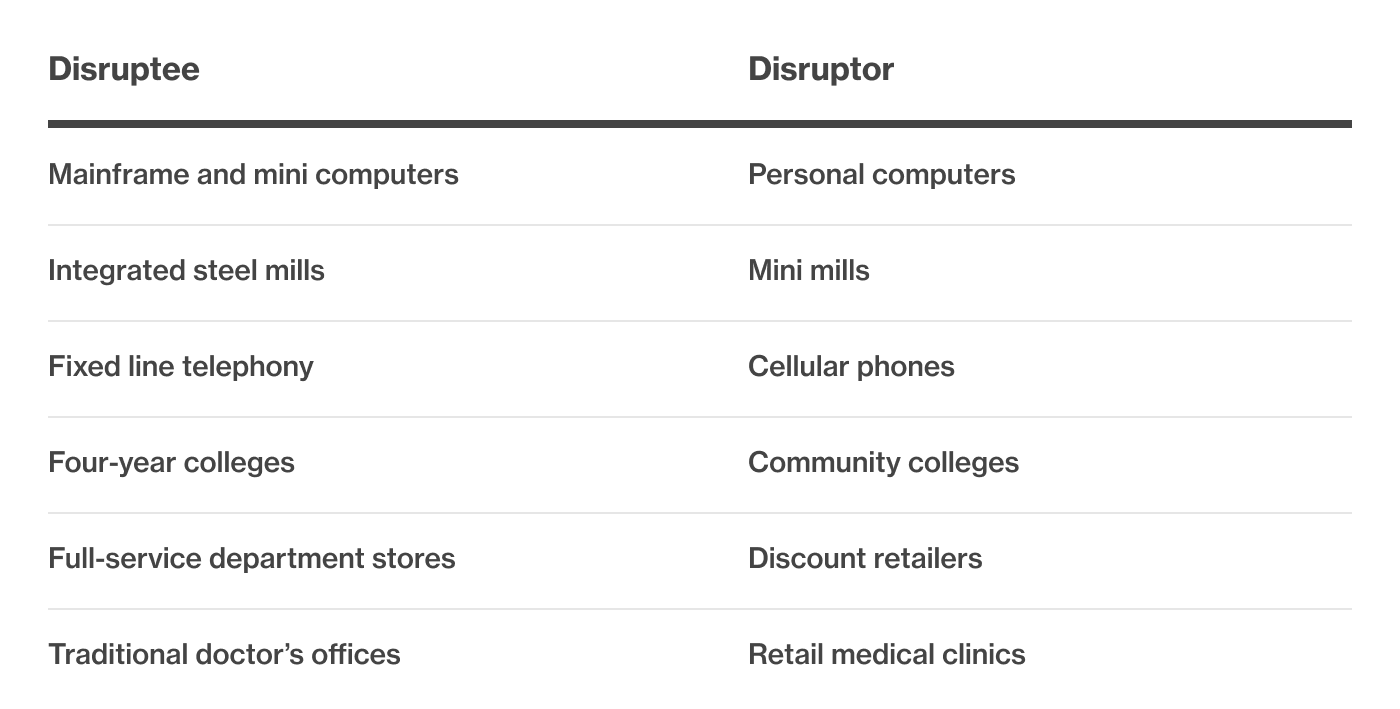

A theory developed by Harvard Business School professor Clayton Christensen in the 1990s, “disruption” has become ubiquitously referenced but widely misunderstood. Contrary to popular usage, disruptive innovations are not breakthrough innovations that make good products better. Instead, they are innovations that either enter at the bottom of the market and serve a lower-profit segment, or that target consumers who previously could not access or afford a product/service. This process is enabled by technological change and business model innovations.

Because disruptive innovations tend to be seen initially as inferior to existing solutions, they are often underrated by incumbents, who rationally focus on serving large existing markets with greater profitability.

This asymmetry of motivation provides disruptors the breathing room to transition from merely “good enough” for a fringe segment to serving customers in the mainstream market. The result is that the process of disruption often causes well-managed incumbents to fail as disruptive innovations steal away their markets.

1. New-market disruption: Targets under-served customers and competes with non-consumption

In every market, there are “non-consumers,” individuals who don’t have the time, money, skill, access, or ability to consume existing offerings. A disruptive innovation introduces an affordable product/service that targets non-consumers—thus creating entirely new consumers within an entirely new value network.

A canonical example of new-market disruption is Airbnb. By making airbeds and extra bedrooms available for booking by guests, Airbnb enabled homeowners to monetize underutilized space and expanded the market for travel. While Airbnb listings lacked the attributes of hotels that mainstream customers valued—cleanliness, consistency, and comfort—they appealed to a different set of values: affordability and the desire for local, authentic experiences. Over time, Airbnb expanded upmarket and captured more mainstream consumers.

2. Low-end disruption: Targets over-served customers

Because management practices rationally focus on serving existing customers and pursuing higher-margin products, firms evolve their products to a point where they offer far more features or functionality than what most people actually need. A low-end disruptive innovation meets the needs of over-served customers by providing sufficient functionality in return for lower prices. An example of low-end disruption would be simple, lightweight photo and video editing apps like Kapwing, PicsArt, and Canva that pull casual users away from premium legacy editing products.

.

While Christensen’s theory of disruption was predicated on competing against non-consumption, the Passion Economy is rooted in workers, and enables people who possess non-commoditized skills to compete against non-production.

Participants in the Passion Economy are individuals whose skills and abilities were previously under-monetized or under-utilized relative to their potential. New technologies and business models in the Passion Economy enable more people to unlock economic value from their creative skills and passions, where they had previously been hampered by traditional intermediaries and unfavorable business models. The “enterprization of the consumer” can be a gradual process, starting with individuals exploring new channels for side hustles, with some eventually graduating to full displacement of traditional employment.

Across multiple verticals, new platforms enable workers to compete against non-production:

Online course platforms like Teachable, Podia, Thinkific, and Mighty Networks allow experts to productize and monetize their knowledge online. Previously, many of these instructors were reliant on in-person classes, coaching sessions, and retreats to generate income—challenging, expensive, and unscalable paths to monetization that often caused many instructors to seek different types of work altogether.

Patreon and Buy Me A Coffee allow more independent creators like podcasters, video creators, and artists to earn a living from fans’ membership payments. While these creators often amassed large followings on advertising-based social platforms, the business model of those platforms made it challenging for creators to earn a viable income, leading many to drop out of their creative pursuits and to remain non-producers.

VIPKid and Outschool allow people to become online teachers, enabling more people to earn a living from teaching than if they had to teach at physical schools.

New podcast tools like Anchor, Supercast, and Glow make it easy for creators to record, distribute, and monetize podcasts. Previously, in order to create an audio show, reach an audience, and monetize, these creators had to be employed at traditional media companies, thereby barring many from entering the industry.

Programs like Github Sponsors enable developers to receive funding from the community directly on the platform and to make a living from contributing to open source projects. Open source developers historically worked on these projects as personal passions without financial gain, supporting themselves through other jobs.

Many successful marketplace companies in the last few decades tapped into this idea of converting non-producers into producers, in terms of making physical assets productive: Uber, for instance, unlocked the economic value of people’s idle cars, and Airbnb converted excess physical spaces into valuable assets. New sources of supply, in tandem with a latent, large pool of under-served demand, created massive economic value. While these marketplaces started by amassing supply in order to attract demand, creators often have the opposite problem: they have already aggregated demand on large social platforms, but struggle with monetization. This is where many new platforms are entering, enabling creators to overcome non-production by offering value that fans would be willing to pay for.

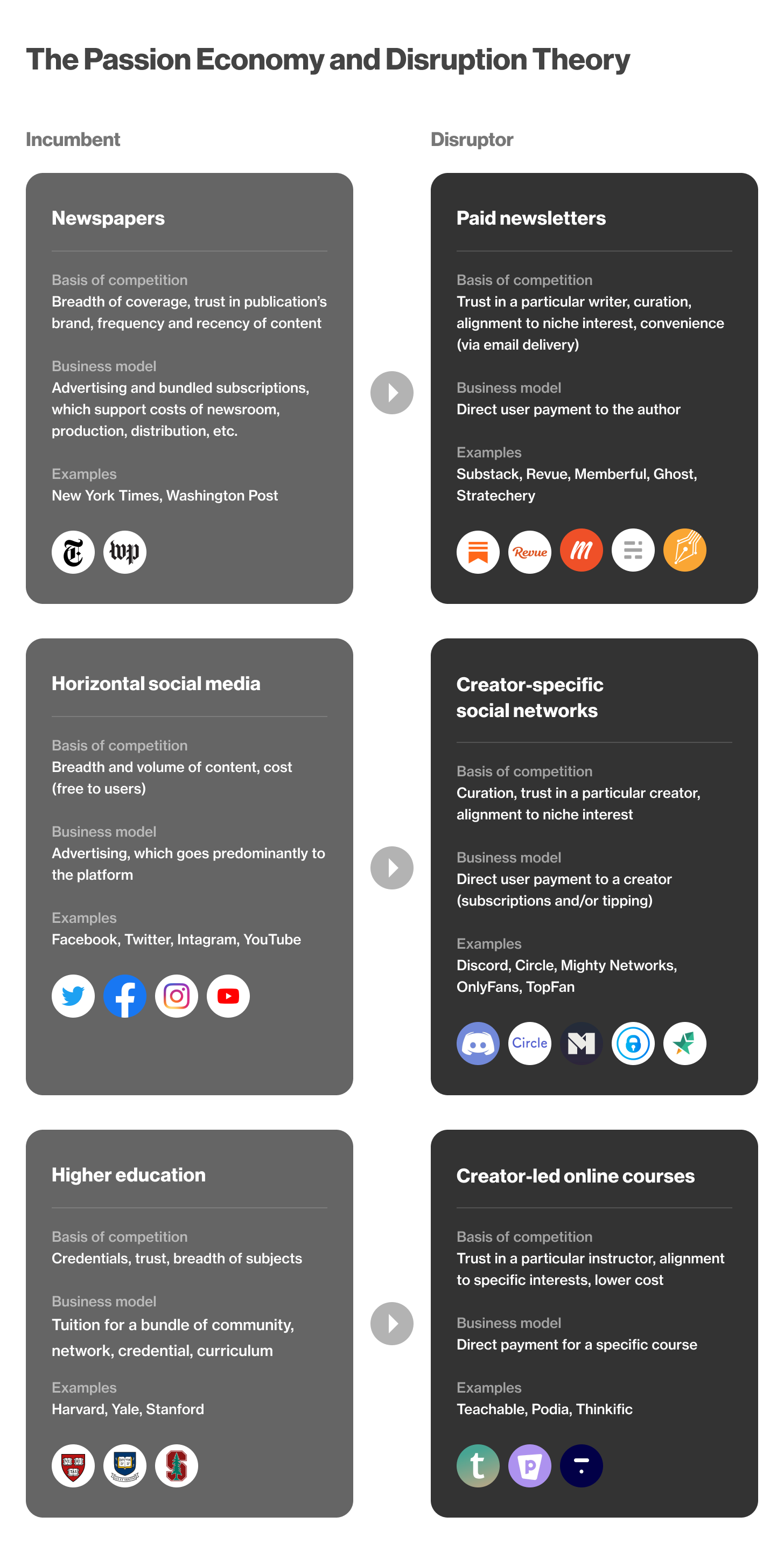

The most powerful, radical industry change happens when non-production is matched with non-consumption. Through this combination, the Passion Economy creates the potential to give rise to both new-market and low-end disruptions.

Because new producers enabled by Passion Economy platforms enter the market, previous non-consumers and over-served consumers in various sectors have a wider range of choices than ever before. Consumers have the ability to choose a creator-led offering that is cheaper, more convenient, and more aligned to their preferences.

For example, a student of technology business strategy may find it prohibitively expensive to subscribe to The Wall Street Journal, Financial Times, and The Economist (non-consumption), or struggle to peruse all of their content (they were over-served). But $12 per month to Ben Thompson’s Stratechery for in-depth tech analysis directly to one’s email inbox is both more affordable and convenient than the bundled, broader alternatives.

Another example of competing against non-consumption can be found in Run the World, an online events platform that allows anyone to set up and host an online event, from traditional conferences to influencer meetups. Run the World events aren’t just targeted to people who can't afford to regularly attend real-world conferences (low-end disruption), but are also pulling in attendees who would otherwise never consider going to a conference (new-market disruption). Because of the ease of use and low cost on the creator side, events can be organized that are more niche and aligned to users’ interests—expanding the market to new events that would have been infeasible or unprofitable to operate offline.

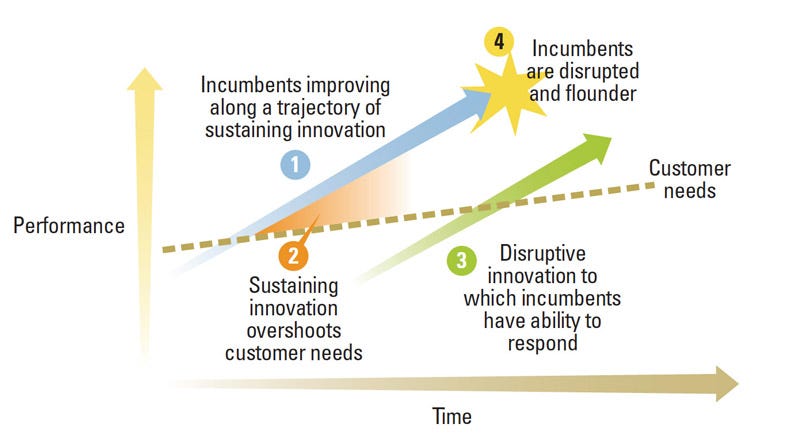

A key characteristic of disruptive technology is that it heralds a change in the basis of competition.

At first glance, virtual events may seem inferior vs. traditional offline conferences—the quality may be hit-or-miss, and opportunities to meet other attendees are more limited. But along a different basis of competition, online events are superior: they are cheaper and more convenient to attend than offline events, and novel features made possible only through software like detailed user profiles and instant 1:1 video chats enable more targeted networking. These features may not appeal to a traditional conference-goer, but they are highly valued by those who can’t access much of the conference circuit or for those who have never attended large professional events.

The basis of competition can also shift from breadth and volume of content among incumbent offerings, to depth and value for Passion Economy products and services. For instance, millions of users turn to ad-driven social media platforms like Twitter and Reddit to stay informed about news and to find interesting content. The value proposition to consumers is the breadth of topics and the cost (free). But increasingly, creators with loyal followings are creating their own independent offerings—ranging from paid courses to niche communities to vertical social networks—with the basis of competition shifting to curated content and community, trust in a particular creator, and alignment to specific topics.

Similarly, while the TV industry offered broad content for mass appeal, new types of specialized entertainment networks like Twitch offer content that is more aligned to specific user interests. Twitch enables anyone to easily start streaming (converting non-producers into producers) and to earn income from a niche, supportive audience who was previously over-served by traditional entertainment (low-end disruption).

Just as vertical-specific services like Craigslist and Redfin chipped away at the advertising revenues of newspapers, new subscription content platforms like Substack and Ghost are now chipping away at the editorial content of traditional media companies. Paid media platforms have tapped into a growing market of users who want greater control over their information diets (i.e. they were over-served), and are willing to pay for high-quality, curated content. Though paid newsletters may be “not as good” as traditional media/journalism on the dimensions of comprehensiveness or brand trust, the basis of competition shifts to quality, curation, and trust in a particular writer. Over time, one could imagine these offerings capturing more mainstream audiences by offering more content types and creating bundles spanning different subjects and authors—all underpinned by a significantly lower cost structure than traditional publications.

Ben Thompson, the author of Stratechery which offers analysis of tech and media, is a prime example of a Passion Economy creator. He wrote earlier this year:

Paid access to analysis is not new; leveraging new technology, particularly online payments and web publishing software, to offer analysis at a drastically lower price and making it up in volume was what made Stratechery’s business model unique. It is low end disruption exactly as Christensen defined it, and it is deeply gratifying and an honor to his legacy to see the model spreading.

To be clear, not every Passion Economy platform is disruptive. Disruptive innovations have low-end or new-market footholds; creator-led offerings that target the high-end of a market are, per Christensen’s definition, not disruptive. For instance, some beauty influencers are making premium tutorials and courses that are more expensive than pre-existing content available on YouTube and are targeting high-end customers who are willing to pay for more well-produced, or perhaps more personalized, content. These are sustaining innovations relative to free content and target high-end customers with better performance than what was previously available.

And note that disruption is always relative to something else: for instance, while YouTube may be disruptive to traditional TV networks, it itself may be disrupted by creator-specific content.

Christensen wrote, “The question is whether there is a novel technology or business model that allows new entrants to move upmarket without emulating the incumbents’ high costs—that is, to follow a disruptive path.”

For the Passion Economy, the catalyst is both technological change and new business models. The Passion Economy has existed in bits and pieces as the internet has developed, but social platforms that have reached worldwide scale and enabled fans to connect with creators, and advancements in technology including reliable video conferencing and mobile payments are finally unleashing the Passion Economy’s disruptive potential.

On the business model side, individuals can more easily launch their own businesses by growing, nurturing, and monetizing an audience via new digital tools and platforms, with their ventures entailing significantly lower cost structures than incumbents for whom talent was just one of many costs (just compare the cost structures of a publication built on Substack vs. a traditional media company). There are secular tailwinds too: automation is driving a shift towards more empathetic, creative work; trust is shifting to individuals versus institutions; and users are more familiar with subscription business models and increasingly willing to pay directly (rather than through their attention on ads) for unique access and expertise.

And then, there’s the specific moment of history we are living through now: since the coronavirus hit, the US unemployment rate has surged to 14.7% in April (conservatively). Beyond the millions of people who are newly unemployed, there are millions more who are working from home, concerned about their jobs, and exploring ways to diversify their earnings. This economic uncertainty creates greater urgency than ever for innovative paths to earn income online—to turn non-producers into producers.

On the consumer side, the concept of non-consumption that underpins disruption theory is now manifesting in multiple ways: people without work will increasingly “non-consume” as they cut discretionary budgets. And many categories of products/services that consumers previously purchased are now non-consumable and require alternatives: online learning is picking up steam because in-person education is not available; online fitness is accelerating because boutique fitness studios and gyms are temporarily closed.

This creates a massive opportunity for new companies to help serve both the huge contingent of non-producers and a growing base of non-consumers.

If you’re building something here, I’d love to chat.

To summarize: Innovations in the Passion Economy represent new businesses that allow workers to compete against non-production. In turn, these workers can develop new products/services that serve previous non-consumers and over-served consumers. This means that across different industries, new Passion Economy platforms have the potential to disrupt incumbents.

In the next post, I’ll delve into 4 major implications of disruption theory for the Passion Economy. Stay tuned next week and subscribe to my newsletter to get it first!